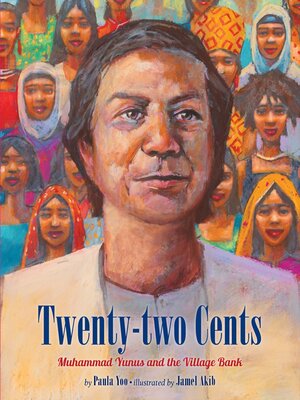

Book Description

for Twenty-Two Cents by Paula Yoo and Jamel Akib

From Cooperative Children's Book Center (CCBC)

Muhammad Yunus grew up in Chittagong, India (now Bangladesh), seeing his mother give food to poor people, one of the many ways he learned about compassion and activism. He eventually became an economist, and when he returned home in 1971 after studying and teaching abroad, he began interviewing poor people to get a better understanding of poverty and how to fight it. He met women like Sufiya who worked hard making and selling crafts, but was unable to get out of debt after borrowing money for supplies at high interest rates from a local moneylender. Realizing small, low-interest loans would enable these women to get ahead, Muhammad was frustrated when no bank would agree to loan to people living in poverty. So Muhammad started Grameen, or “village,” Bank in 1977 to help transform the lives of people in poverty. Muhammad and Grameen Bank won the Nobel Peace Prize in 2006. An afterword tells more about microfinance and Grameen Banks, which can be found around the world, including here in the United States. (Ages 7–10)

CCBC Choices 2015. © Cooperative Children's Book Center, Univ. of Wisconsin - Madison, 2015. Used with permission.